BSNL in partnership with SBI has launched its mobile wallet dubbed as “Mobicash” on 17 December, 2017 in four states Punjab, Rajasthan, Haryana, and Bihar, and is expected to expand pan-India on 25 December, 2016 to facilitate urban as well as rural mobile customers to make digital payment. The targeted customers of this service are all those population of semi-urban and rural where traditional banking services are either not available or are very far from the village.

The Mobicash wallet can be used from any phone whether it may smartphone or simple basic phone. Smartphone users can download Mobicash app on their phone and basic phone users can avail mobicash services through SMS and USSD code.

The Mobicash wallet is a prepaid virtual wallet, in which a BSNL customer can preload a certain amount in the account created with the mobile wallet service provider, and then customer can spend it at online and offline merchants.

The BSNL Mobicash wallet facilitates its users to deposit and withdraw cash through BSNL retail outlets and it can also be used to transfer funds, recharge mobile numbers for BSNL Prepaid, pay BSNL landline and Postpaid bills, opt for balance inquiry and mini statement.

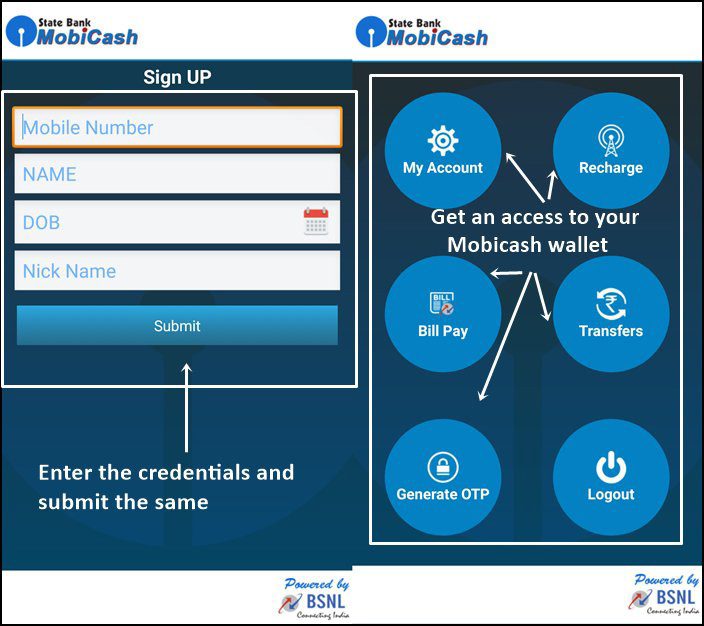

To use Mobicash wallet service you have to do following

Visit BSNL’s customer service point (CSP) (which are basically all those retailer or mobile shopes who are selling BSNL mobile recharge etc) where you have to fill a form for free for non-KYC compliant account and with Rs 20 for a fully KYC compliant account and follow the procedure to activate your mobicash wallet services.

On activation of Mobicash, users will receive a 6 digit default MPIN and a 12 digit Wallet ID. Customers needs to change the default MPIN before using the facilities and don’t do not disclose it to anyone.

Smartphone users can send an SMS to 9870888888/9967878888 and they will receive a return SMS containing a link accessing which the users can download the Mobile Wallet app using the GPRS connection.

Basic phone users can use Mobicash services over SMS

The next step is to deposit the amount for loading the Mobcash Wallet with the CSP.

The Mobicash wallet provides following feature in phase one

- Cash In

- Cash Out

- P2P

- Retailer Initiated

- Recharge BSNL

- Pay BSNL Bill

- Wallet to Wallet money transfer

- Wallet to Bank Account money transfer

And in second phase following services will be added

- Utility Payment (i.e. Electricity, Water, Insurance Premium Payment

- Merchant Payments(Bookmyshow, Cab services, IRCTC, Bus Booking)

- Recharge Other Operators

- Pay Other Operator’s post-paid/Broadband Bill Payment

- Cash In using Mobile/Net Banking from SBI A/c or any other Account

- DBT (Direct Benefit Transfer)

- MGNREGA PAYMENT

- Pension Payment/Scholarship

To use mobicash services, customer have to pay 0.50% ( minimum Rs 5 and maximum Rs 20) for loading the cash in wallet while for withdrawing money, customer have to pay 2.5% ( minimum Rs 10 and maximum Rs 50). Customer can also transfer fund from one wallet to another wallet with a fee of 3% ( minimum Rs 12 and maximum Rs 120).

BSNL customers can use USSD code *511#

The SMS can be sent to 51516 (for BSNL user) or 9418399999 (Other than BSNL user) and the list of codes are given below